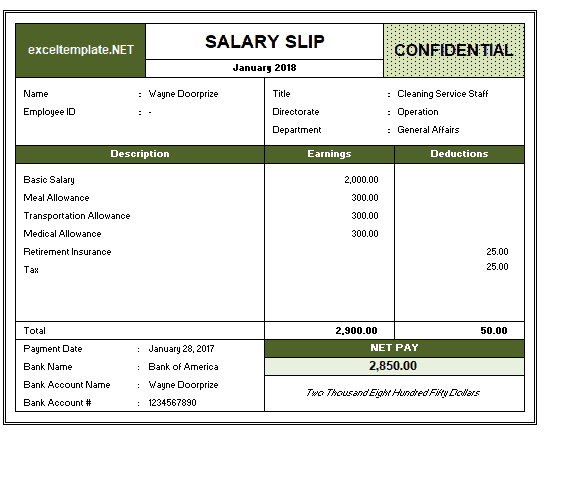

Dearness allowance da is directly based on the cost of living. Basic is the first component on the earnings side of the salary slip.ĭearness Allowance paid to offset the impact of inflation on one’s pay. The salary is 100% taxable in the hands of the employee. Organizations tend to keep basic low so that the allowance pay won’t be topped. As the employee grows in the organization, other allowances tend to be higher. At junior levels, the basic tends to be high. It forms the basis of other components of the salary. Basicīasic, as the name suggests, is the basic component of the salary. The income part of the salary slip has a basic salary and allowances. Salarys components primarily fall under two categories: Income/Earnings and Deductions. Understand what percentage of the salary is forced savings (Employee Provident Fund EPF, ESI, etc.)Ī salary slip or pay slip will have basic information like company name, employee name, designation and employee code, etc.

SAMPLE SALARY SLIP IN EXCEL FULL

Optimize tax liability by making full use of the deductions available.Choose smartly from competing offers when one is looking to switch jobs.However, here’s why its essential to understand salary slip format better. However, how many understand the salary slip format and components of salary slip to its entirety? The confusing terms and figures are like a puzzle that one doesn’t want to solve.įor most people, the importance of salary slip is only when they apply for a loan or a new credit card.

SAMPLE SALARY SLIP IN EXCEL PDF

The employee can download salary pay slip in pdf formats. The employer generates a salary statement every month. Salary slip format What are the Components in a Salary Slip? The below components that form part of the Deductions side of the salary statement are: The below components that form part of the Income/Earnings side of the salary statement are:

0 kommentar(er)

0 kommentar(er)